An OMS in the monetary markets may also be referred to as a commerce order management system. An order management system (OMS) is an electronic system developed to execute securities orders in an environment friendly and cost-effective method. Brokers and dealers use an OMS when filling orders for various types of securities and may track the progress of each https://www.xcritical.com/ order throughout the system. Best Execution is a regulatory requirement mandating brokers to seek essentially the most favorable execution terms for his or her client’s orders. This obligates them to contemplate elements such as worth, pace, and chance of execution.

For businesses, an order management system is a digital method of tracking an order from the order entry to its completion. An order management system will record the entire information and processes that occur by way of an order’s lifecycle. This includes order entry, pathways, inventory administration, order completion, and after-order follow-up/services. Typically, solely trade members can connect on to an trade, which means that a sell-side OMS often has change connectivity, whereas a buy-side OMS is concerned with connecting to sell-side companies.

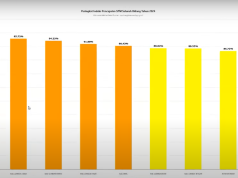

Tca & Trade Analytics

Traders and their funding companies can significantly profit from leveraging an EMS to streamline their trading activities, entry real-time market information, and obtain faster and more efficient trade execution. When buyers purchase and sell shares, bonds, and different securities on the stock market, they place orders (or trades). The orders are despatched to a dealer, who directs them to the suitable exchange or dealer community (routing). Later, Execution Management System (EMS) technology was developed to give sell-side brokers and day merchants the ability to participate in a fast-evolving digital market. Buy-side interest in EMS instruments gained traction when vendors began offering international, multi-asset class platforms.

One mistake I see corporations make is choosing an OMS supplier that doesn’t offer the built-in, superior EMS functionality they want. Having to tack on a third-party EMS can lead to clunky, FIX-only workflows and elevated overhead. A good EMS integrates compliance into every stage of your workflow to maintain your trades flowing with out fear of noncompliance. Watch how open architecture, interoperability and front-to-back platforms are reshaping fintech for funding managers and asset owners. Read how State Street and Charles River are supporting our clients with choices that help manage the transfer to T+1.

They can also generate quick, accurate execution stories and transactional value analysis (TCA). For over 15 years, I even have been advising and consulting with shoppers on funding management know-how options. Below, I leverage that experience to detail key functionality and what to search for in an OMS and EMS, in addition to an OEMS.

Buying And Selling – Order And Execution Management

We will delve into its options, advantages, and the necessary thing distinctions between an EMS and different associated methods. By the end of this text, it’s our objective that you ought to have a clear understanding of what an EMS is and the means it can enhance trading operations. Therefore, choosing an OMS will depend upon the type, size, and scope of the enterprise involved. A buying and selling OMS will often route orders to the most effective change by means of worth and execution or will allow a trader to manually route which exchange to ship the order to. Businesses—ecommerce companies and sellers in particular—also use an OMS to streamline and automate the sales and success process from the point of sale to delivery to the shopper.

It’s a software program platform that gives merchants with real-time market knowledge, advanced execution choices, liquidity administration instruments, and transaction cost analysis. It enables traders to execute trades quickly and efficiently, optimising their buying and selling strategies and bettering overall execution high quality while minimising buying and selling costs. An Execution management system, or EMS, is an application utilized by traders designed to show market data and provide seamless and fast entry to trading locations for the aim of transacting orders. The Charles River Network enables quick and reliable direct entry between buy-side purchasers and sell- facet brokers. It helps world digital buying and selling through FIX and offers entry to over seven hundred world liquidity venues.

About MTS BondsPro MTS BondsPro is an digital buying and selling platform that gives access to liquidity and real-time execution on its nameless, all-to-all order book. It helps USD and a variety of non-USD denominated company bonds and rising order execution management system market debt. MTS BondsPro is part of MTS Markets International, Inc. (MMI), a FINRA-registered broker-dealer. Octaura is a leading provider of electronic buying and selling, information, and analytics solutions for syndicated loans.

Guide To Execution Management System (ems) [capabilities & Vendors]

The OEMS eliminates the multiple interfaces, fragmented workflows, and order staging issues inherent in utilizing separate order and execution management platforms. Traders now not have to change between systems or re-key important info, serving to save time and cut back errors. Benefits beyond the buying and selling desk embrace improved compliance and auditing, lowered operational threat, and less complicated infrastructure. It covers functionalities like rebalancing, order routing, and real-time portfolio analytics. OMSs primarily cater to front- and middle-office features, enabling investment managers to streamline every day funding workflows, automate allocations, ensure compliance, and improve order planning. While OMSs could offer execution capabilities, they are primarily utilized by portfolio managers to manage portfolios and generate orders primarily based on their investment strategies.

Additionally, the SEC requires brokers/dealers to inform customers if orders usually are not routed for best execution. An OMS helps merchants enter and execute orders, from the straightforward to the advanced, more effectively. Some OMSs also can automate trading strategies or risk-mitigating measures corresponding to stop-losses and trailing stops. A reliable order and execution administration system ought to offer automatic and handbook hedging to monitor and handle consumer exposures and overall danger, with advanced filtering for particular person groups or accounts. It also wants to present detailed views of exposures at each currency and forex pair ranges and include instruments to monitor dealer hedging positions. In addition, today’s EMSs present traders with more in-depth, real-time market knowledge and insights.

Their purchasers rely on consistent, clear, and fast commerce execution at unbelievable speeds for retention. The OEMS enables merchants to work extra productively focusing on orders requiring excessive touch interaction, managing trade danger, and demonstrating greatest execution. Full trade lifecycle support, integrated compliance and workflow automation permits purchasers to handle the most important and most advanced institutional portfolios on a single platform.

What An Order Management System (oms) Does For Finance, Enterprise

SS&C Eze is helping 1,900 global asset managers remodel their funding process to optimize operational and investment alpha and develop their business. Finding the best associate is essential to help ensure readiness, manage danger and keep away from failed settlements. We’re well-positioned to assist your shift to T+1 by providing a variety of advanced services. EMSs can be built-in with Order Management Systems (OMS) to supply seamless workflows in the front and middle office. If the capabilities are joined in a single system, it is known as an Order Execution Management System (OEMS), or typically an OMS Trading System.

BestX® is a Technology Company, with a simple payment based mannequin, creating cutting-edge software program to provide real-time, interactive analytics. We provide our clients with a degree playing subject to allow them to assess and evaluate the quality of their FX, Fixed Income and Equities transactions. BestX provides a very open-architecture analytics service working autonomously from any liquidity provider or execution venue. BestX is recognized by more than 120 of the world’s largest Asset Managers, Hedge Funds, Sovereign Wealth Funds and Banks as the Industry Standard for TCA & Best Execution Analytics. Many orders sent to a broker are market orders, which embrace the instruction to buy or promote a safety instantly on the current value. Some types of orders have conditions connected that restrict or alter how and when they are often executed.

Executing a large order all of sudden can move the market, causing unattractive worth adjustments. When investors place market orders, they want them executed as rapidly as potential, at the most effective out there current price. If the value adjustments between the time the investor locations their order, and the time the order execution is complete, the investor might be uncovered to slippage. Enter new markets and deploy new strategies with out disrupting your workflows with a multi-asset, built-in PMS/OEMS/analytics framework.

Ensure sooner time to launch, higher organizational effectivity, and a dramatic reduction in technical complexity—all of which reduces prices across your firm. If the trade era course of is clunky and inefficient, it wastes useful time and places you at a better risk for errors and missed opportunities. Still, they continue to be central to investment firms’ ability to streamline the funding processes important to their operation and preserve a aggressive edge. Businesses can use OMS to maintain observe of buyer orders from level of sale to supply and to care for returns and refunds. This is very useful for companies which have a excessive quantity of sales or depend on shipping through ecommerce. For evaluation, the buy-side is a segment of Wall Street made up of investing institutions corresponding to mutual funds, pension funds, and insurance firms that have a tendency to purchase giant parts of securities for money administration purposes.

Anvil Execution

Finally, your OMS platform should be capable of grow and scale with you as your wants change – they usually most certainly will. Without that scalability, you might be pressured to pay for expensive upgrades, custom enhancements, or system replacements. And the complete value of ownership of your solution will outpace any savings you thought a more “affordable” option may provide. Integration with Order Management Systems (OMS) allows for seamless workflow and improved operational efficiency. Here are two areas to concentrate to when identifying a reliable order execution system.

However, communicating transactions can additionally be accomplished via the utilization of a customized application programming interface (API). The FIX protocol links hedge funds and funding companies to hundreds of counterparties around the world utilizing the OMS. Also, ask your expertise vendor whether service is included or separate from your expertise cost. If it’s separate, you may be stuck with unexpected or “hidden” charges, which might increase your total cost of possession.